Abstract

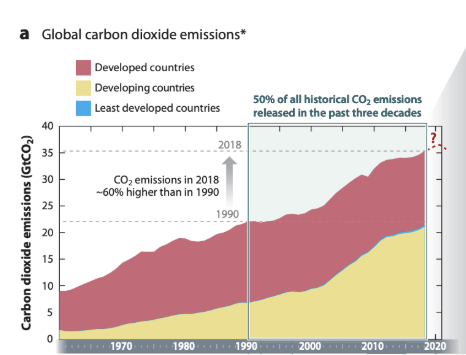

This essay critically examines the effectiveness and limitations of carbon pricing as a core climate policy strategy. Although carbon pricing—through tools like carbon taxes and emissions trading systems—has been promoted as an efficient market-based solution to reduce greenhouse gas emissions, the outcomes have been disappointing. CO₂ emissions were about 60% higher in 2018 than in 1990, and half of all historical emissions occurred after 1990 (Green et al., 2020), despite decades of carbon market expansion. Drawing on foundational theories of externalities by Pigou and Coase, as well as critiques by Hickel (2019), Paterson (2017), and Nightingale (2022), the paper argues that carbon pricing cannot deliver deep decarbonization on its own. Instead, it advocates for Green Industrial Policy (GIP) and structural economic transformation as more promising and just solutions to the climate crisis.

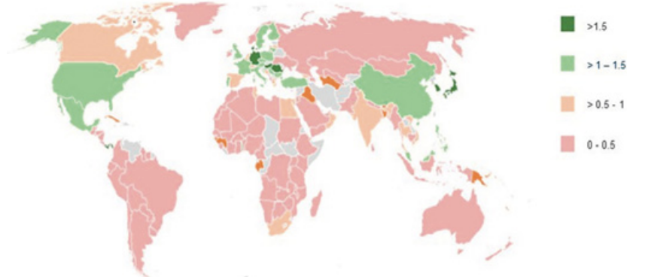

Figure 1 Revealed comparative advantage in low-carbon technology products and environmental goods (2019–2021) – Amir Lebdioui

Introduction

Since the 1990s, carbon pricing has become the dominant tool in climate policy. Rooted in Pigovian economics, the idea is that polluters should pay for the social damage they cause by emitting greenhouse gases. By putting a price on carbon—through either taxes or emissions trading systems (ETS)—governments can create market incentives for companies and individuals to reduce emissions and shift toward greener alternatives. Institutions like the World Bank, UNFCCC, and IRENA promote these tools for their flexibility, economic efficiency, and potential to raise revenue for public investment.

However, emissions continue to rise globally. According to the International Energy Agency, energy-related CO₂ emissions hit an all-time high of 36.8 billion tons in 2022. Meanwhile, the World Bank (2022) reports that only 23% of global emissions are covered by carbon pricing, and most prices are far below the level required to meet the 1.5°C Paris target. Green et al. (2020) show that carbon pricing has had limited impact due to price volatility, weak enforcement, and manipulation by vested interests. This essay explores why carbon pricing has fallen short and evaluates whether alternative approaches—particularly state-led Green Industrial Policy—offer a more robust and just path forward.

Methodology

This study uses a qualitative methodology grounded in a comparative literature review. It draws on theoretical texts in economics and political ecology, peer-reviewed empirical studies, and institutional reports. Key economic thinkers include Arthur Pigou and Ronald Coase, while critical perspectives come from Jason Hickel, Matthew Paterson, and Andrea Nightingale. The empirical backbone comes from data synthesized by the World Bank (2022), the International Energy Agency (IEA), Green et al. (2020), and reports on Green Industrial Policy (Anzolin & Lebdioui, 2023). The method emphasizes conceptual clarity, policy outcomes, and social equity implications.

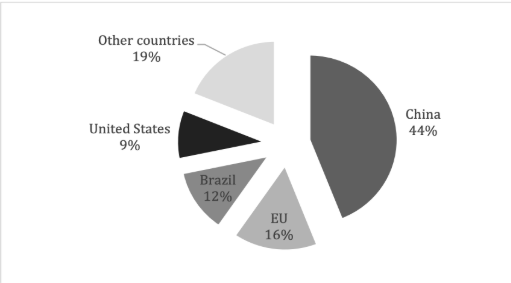

Figure 2 – Distribution of renewable energy employment across countries in 2014 (in thousand jobs) – Authors’ based on data provided by IRENA (2016)

Literature and Analysis

Jason Hickel (2019) argues that the global push for continuous economic growth—measured by Gross Domestic Product (GDP)—is fundamentally incompatible with ecological sustainability. He points out that GDP only captures the market value of goods and services and ignores ecological costs like biodiversity loss or carbon emissions. According to Hickel, the belief in “green growth”—the idea that economic expansion can continue while reducing environmental damage—is not supported by the evidence. He cites data showing that although some high-income countries have achieved relative decoupling (reduced emissions per unit of GDP), absolute emissions and material throughput continue to rise globally. For instance, global material use rose from 50 billion tons in 2000 to over 90 billion tons in 2017, with emissions following a similar trend. Hickel argues that high-income countries are already consuming resources at rates far beyond the Earth’s regenerative capacity. As a solution, he calls for post-growth or degrowth models, which would emphasize redistributing income, shortening working hours, and expanding universal public services, all while reducing pressure on planetary systems

I find Hickel’s argument compelling because it forces a rethinking of what we mean by progress. If growth drives both ecological overshoot and inequality, then models centered on well-being, rather than GDP, seem both necessary and ethical.

Matthew Paterson (2017) deepens this critique by linking the climate crisis to capitalism’s historical and systemic dependence on fossil fuels. He introduces the concept of metabolic rift, derived from Marxist ecological theory, which describes how industrial capitalism has disrupted the natural exchange between humans and ecosystems. This happens through a linear process of extraction, production, consumption, and pollution—with no regard for ecological regeneration. Paterson supports his analysis by referencing the Jevons Paradox, which shows that improvements in energy efficiency—such as better engines or lighting—can actually increase overall energy use by lowering costs and boosting demand. These ideas show that technological solutions are often undermined by systemic pressures toward consumption and growth. Paterson also critiques classical economic theories: while Arthur Pigou proposed correcting pollution through taxation (Pigovian taxes), and Ronald Coase suggested solving externalities through negotiation, Paterson argues these models underestimate capitalism’s structural commitment to profit and accumulation, which makes environmental destruction inevitable without systemic change.

I agree with Paterson’s view that we cannot rely on pricing mechanisms alone. His theory of the metabolic rift helped me see that climate change is not just a side effect of bad behavior—it’s built into the structure of how our economy works.

Andrea Joslyn Nightingale (2022) focuses on the social and political dimensions of climate policy. She argues that mainstream approaches, such as carbon trading or carbon capture, are overly focused on technical fixes. These solutions often ignore how climate change is experienced unequally across different social groups. For example, wealthy emitters may afford new technologies, while marginalized communities face increased climate vulnerability. Drawing on Amitav Ghosh’s concept of the Great Derangement, Nightingale critiques how societies fail to imagine the deep structural changes needed to address the crisis. She argues that climate change should be seen as a socio-natural phenomenon—shaped by colonial histories, unequal exposure, and power imbalances. While technical fixes might reduce emissions, they do not address who is most affected or who benefits from green transitions.

Nightingale’s view helped me realize that climate solutions must also be justice solutions. Technology alone is not enough—it matters how it’s used, and who it helps.

The World Bank (2022) continues to promote carbon pricing—especially through carbon taxes—as a key tool to reduce emissions. Based on Pigovian theory, carbon taxes correct negative externalities by attaching a monetary cost to pollution. The Bank argues that this creates market incentives to switch to clean energy, and highlights that 70 carbon pricing initiatives now exist globally, covering about 23% of global emissions. It also promotes tax-shifting, where carbon tax revenue is used to reduce other taxes or fund social programs. Organizations like IRENA and the UNFCCC endorse carbon pricing as part of meeting Paris Agreement goals.

However, the report also acknowledges major obstacles in the Global South, including institutional weaknesses, energy poverty concerns, and fossil fuel lobbying. The UNFCCC emphasizes the need for capacity-building—developing governance systems to manage carbon taxes fairly.

While I see the logic in carbon pricing, the data suggests it is often too slow and politically constrained. I think real-world implementation issues make it less effective than theory promises.

Green et al. (2020) in Three Decades of Climate Mitigation provide a sobering assessment. They report that global CO₂ emissions in 2018 were 60% higher than in 1990, and that half of all cumulative emissions have occurred since 1990—even though carbon pricing mechanisms have become more widespread during this time. Their review criticizes emissions trading schemes and carbon offsets for being weak, volatile, and easily manipulated. For example, some offset schemes allow polluters to “cancel out” emissions by paying for forest projects, even if those projects were already underway or didn’t prevent new emissions. As they put it, “carbon pricing has often been chosen for political acceptability, not environmental necessity.” They argue that market-based tools often delay systemic reforms and shift attention away from stronger regulation and direct investment

Figure 1 – Graph showing increases in CO2 emission (From Annual Review of Environment and Resources Three Decades of Climate Mitigation: Why Haven’t We Bent the Global Emissions Curve?)

This made me question whether carbon pricing is achieving anything meaningful. If emissions keep rising, maybe it’s time to rethink our tools, not just refine them.

Conclusion

This essay has argued that carbon pricing, though theoretically sound, has consistently underperformed as a climate policy. Emissions have continued to rise, and the tools of carbon taxation and emissions trading have proven too weak, too politically constrained, and too easily manipulated. The underlying problem lies in treating climate change as a market failure, rather than a structural feature of fossil-fueled capitalism. By contrast, Green Industrial Policy offers a more transformative approach—one that aligns economic planning, social justice, and ecological sustainability. Authors like Hickel, Paterson, Nightingale, and Lebdioui show that the future of climate policy must go beyond prices and confront the deeper forces shaping the crisis. If we are to achieve meaningful climate action, we must abandon narrow efficiency tools and embrace bold, redistributive strategies for system-wide change.